Blog

Discover our latest articles on invoice and payment management in Switzerland.

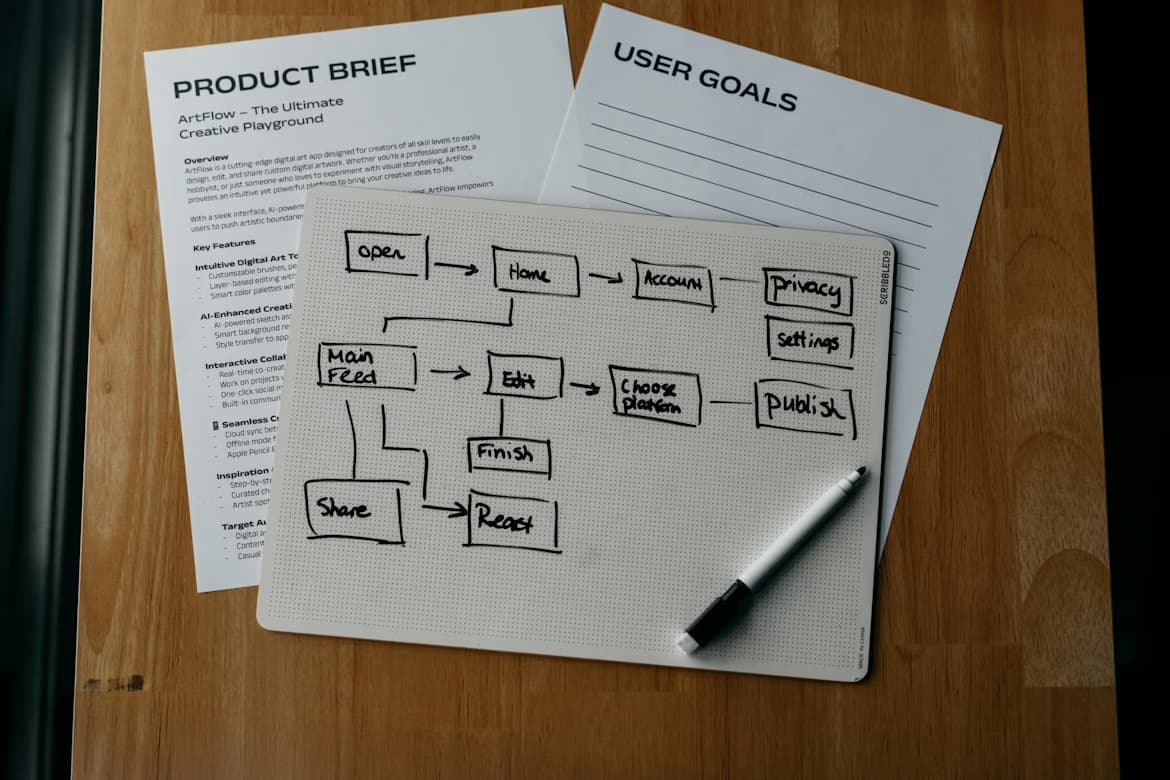

Project-based invoicing: managing costs and margins effectively

A project's profitability is determined during the budgeting phase and confirmed through rigorous tracking of actual costs. Between time spent, external charges and direct expenses, mastering project-based invoicing requires method and suitable tools to avoid overruns and preserve your margins.

How to create a compliant invoice in Switzerland: complete guide for freelancers and SMEs

Creating a compliant invoice in Switzerland requires respecting precise mandatory information, integrating a QR-code since 2020 and correctly managing VAT. This complete guide details all required elements, numbering rules and best practices for professional invoicing in full compliance.

Invoice reminder: effective email examples to get paid quickly

Late payments threaten your company's cash flow. A well-worded reminder can make all the difference between quick payment and costly litigation. Discover effective reminder email templates, tailored to each situation, to recover your unpaid invoices without damaging the client relationship.

Free invoicing software: what are the advantages and limitations?

Free invoicing software attracts users with its immediate accessibility, but often hides significant functional limitations and risks for your business. This article objectively examines the advantages and disadvantages of free versions compared to paid solutions, to help you make an informed choice based on your situation.

Artificial intelligence is revolutionising accounting for SMEs

Artificial intelligence is progressively transforming accounting for SMEs, from automatic invoice recognition to cash flow prediction. But between technological promises and reality on the ground, what are the truly useful use cases and the limitations to know for Swiss businesses?

Card payment: benefits, costs and consequences for an SME

Accepting card payments represents an investment that directly impacts your cash flow and customer relations. Between commissions, fixed fees and payment delays, actual costs vary greatly depending on providers. This guide details pricing, simulates costs for a Swiss SME and helps you choose the solution suited to your business.

Paper invoice vs electronic invoice: is there still any point to paper?

Is the paper invoice still relevant in 2025 compared to electronic invoicing? Comparison of costs, archiving constraints, client acceptance and legal compliance in Switzerland. Discover which solution best suits your business.

Creating your SME's budget forecast: methodology and tips

Creating a budget forecast is essential for managing your SME with confidence and anticipating difficulties. Discover a 5-step methodology to build your budget, track budget vs actual, and adjust during the year without losing direction.

Certified electronic archiving: understanding the Olico ordinance

The Olico ordinance defines the legal framework for electronic archiving in Switzerland. It sets out the technical requirements for storing your digital documents in compliance for 10 years. Understanding these rules helps you avoid errors during tax audits.

VAT exemption (< CHF 100,000): should you register voluntarily?

Is your turnover below CHF 100,000? You benefit from VAT exemption but can choose voluntary registration. This guide analyses the advantages and disadvantages of this option to help you make the right decision based on your situation.

Collaborating online with your fiduciary: saving time and improving efficiency

Digital collaboration between businesses and fiduciaries transforms accounting management by enabling shared access to invoicing data and accounting documents. This approach reduces email exchanges, accelerates closings and improves the quality of advice. Discover how to implement this efficient collaboration.

Accounting software: cloud or local installation?

Choosing between cloud accounting software and a local installation directly impacts your costs, flexibility and compliance. SaaS solutions offer accessibility and automatic updates, whilst local software promises control and independence. Discover the advantages and disadvantages of each approach for Swiss SMEs.